Getting out of credit card debt might seem scarier than facing a horde of squirrels armed with tiny credit cards, but fear not – it's totally doable!

Credit card balances soared to new heights in 2023, reaching a whopping $1.08 trillion. Add inflation and the high cost of living to the mix and you get record high credit card balances.

The average credit card APR remains stubbornly above 20 percent which means you end up paying more just servicing your debt. Borrowers making the minimum payment on an average credit card balance of $6,000 at the average rate of 20.74% would be in debt for more than 17 years and end up paying $9,000 in interest.

Short of receiving a large inheritance from a mysterious old relative, there is no quick-fix solution for getting out of debt, despite what solicitors or infomercials might have you believe.

However, a combination of smart money moves can reduce your debt, lower your credit card APR and put you on the right track toward a debt-free life.

Here are 4 techniques for paying off credit card debt the smart way.

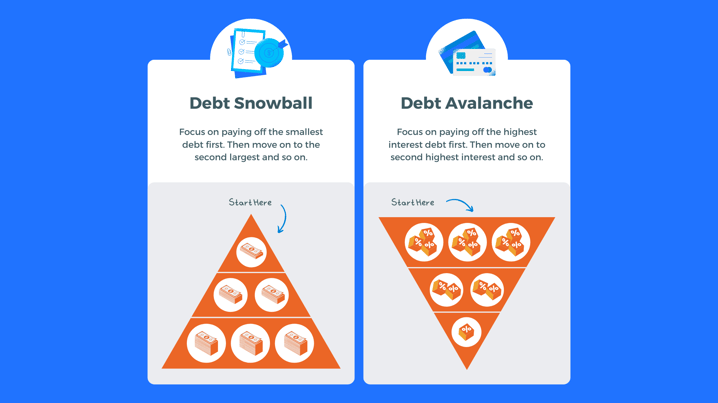

1. Try the avalanche method

Who this strategy is good for: Those motivated by interest savings

If you want to get out of debt as quickly as possible, list your debts from the highest interest rate to the lowest. Make the minimum monthly payment on each, but throw all your extra cash at the highest interest debt. This is sometimes called the debt avalanche method of repayment — “avalanche,” because you’re prioritizing taking down your most expensive debts in the long term first.

If you have, say, $600 per month you can budget for paying off debt, you would use the majority of those funds to pay off the highest-interest debt first. Once that debt is paid off, you can focus those funds on the next-highest-interest debt and eliminate it faster, since you won’t have as much interest to pay off.

Consistency is key, stick to this approach consistently each month. The goal is to aggressively pay down the highest-interest debt.

Pay a bit extra each month if you can. Every dollar over the minimum payment goes toward your balance—and the smaller your balance is, the less you have to pay in interest. Changed makes it easier for you to send extra money towards your debt.

2. Test the snowball method

Who this strategy is good for: Those motivated by small successes

With the snowball method, you pay off your debts from smallest to largest. Getting a debt paid off in the shortest time possible is a good motivator that could help you stay on track.

As with the avalanche method, you make the minimum monthly payment on each debt, then you go full out on the one you’re focused on paying off. Once you’ve repaid it in full, you put the money you were allocating to it toward the next-largest debt on your list — the “snowball” amount that gets larger as you pay off debts.

If possible, add a little more money each month. Every dollar beyond the minimum payment helps reduce your balance, and with a smaller balance, you pay less in interest.

3. Get your spending under control

Who this strategy is good for: Anyone lacking a sufficient budget

Credit card debt can happen because of unexpected medical bills or emergencies. It can also come from spending more than you save or have in your account regularly. Which is why you need a budget.

Here is a blog on how to get a budget glow up, if you are not sure where to start.

But a simple budget should account for:

- Must-Haves: Rent or mortgage, utilities, groceries, and gasoline.

- Debts: Minimum payments on credit cards and other debts.

- Nice-to-Haves: Dining out, coffee, and entertainment.

- Occasional Expenses: Insurance, car repairs, haircuts, and other irregular costs.

After listing your expenses, go through each item and find ways to free up enough money each month to pay off all your debts in 12 to 18 months.

4. Grow your emergency fund

Who this strategy is good for: Anyone lacking a significant emergency fund

If you don't have a lot of savings, using credit cards too much can be a problem. This happens when you can't borrow from friends, family, or cut down on spending.

Before dealing with debt, it's important to save some money first. Aim for at least $500 in short-term savings while making the smallest payments on your credit cards. Changed can help you save seamlessly as you pay down your debt with Stash My Cash

This way, if you face unexpected expenses, you can use your savings instead of relying on your credit card.

Are you ready to say goodbye to your credit card debt and do debt differently?