When you finally pay off a debt, it's like shedding a heavy burden, granting a newfound sense of freedom and control over your financial path. However, this liberation can sometimes come with unforeseen consequences, including a potential decrease in credit scores. For a comprehensive breakdown, check out our detailed blog on credit scores.

Here are four reasons why this might occur, along with why it's not necessarily a cause for concern:

-

Reduced Overall Credit Limit: While paying off credit card debt is usually a wise decision due to their high interest rates, closing these accounts afterwards can increase your credit utilization ratio, which constitutes 30% of your FICO score. This may lead to a drop in your credit score, unless the card carries an excessive fee. It's advisable to keep such cards open to maintain a healthy credit utilization ratio.

-

Lowered Credit Age: Credit scoring models favor individuals with long-term credit relationships, with the average age of credit accounts contributing 15% to your credit score. Paying off a loan or closing an older credit card account can decrease your credit age, potentially causing a decline in your score. While it's not a reason to avoid paying off a loan, it's important to be aware of this potential temporary decrease.

-

Changes in Credit Mix: A mix of credit types, such as credit cards and installment loans, is viewed positively by credit scoring systems and accounts for 10% of your FICO score. If you pay off a student loan or car loan, leaving only credit cards as open accounts, your credit mix will change, possibly leading to a slight score decrease.

-

Other Factors: Fluctuations in credit scores are normal and can be caused by various factors. Late payments on other accounts, an increase in the balance on another account, opening new credit, or errors on your credit report can all contribute to a drop in your credit score. It's recommended to monitor your credit reports regularly to ensure accuracy.

So, while paying off debt feels great, it's crucial to understand its impact on your credit. Remember, score dips are often temporary, and with sound financial decisions, you'll rebound in no time.

When can I expect my credit scores to increase after clearing my debts?

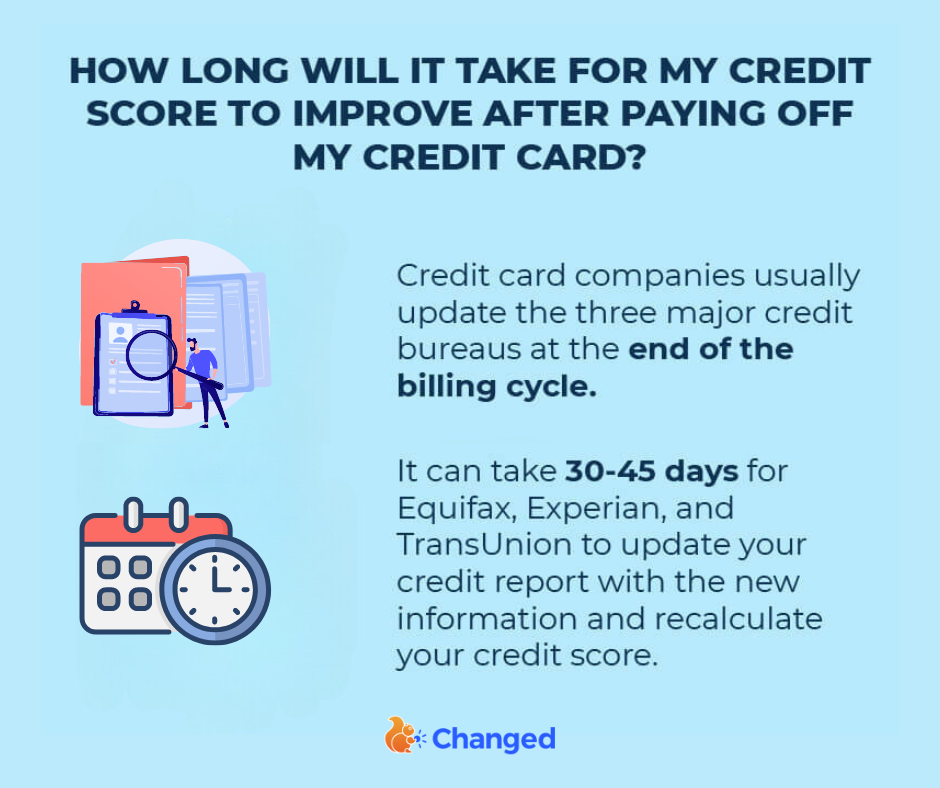

Paying off debt typically boosts credit scores by improving factors like credit utilization ratio and payment history. While you can expect to see improvements within a few months, the timeline varies. Creditors report account statuses every 30 to 45 days, so it may take a billing cycle or two for changes to reflect. However, factors like the diversity of your credit accounts and other negative items in your credit history can influence the extent and speed of score increases.

How long after paying off debt will my credit scores change?

Updates from creditors to the CRAs occur roughly every 30 to 45 days, so expect changes within a month or more after debt repayment.

So, should I be paying off my debt if it's going to lower my credit score?

In the grand scheme, despite nuances in credit score dynamics, paying off debt is always wise. Any score fluctuations are temporary, akin to turbulence on the flight to financial freedom. Rest assured, your score will recover.

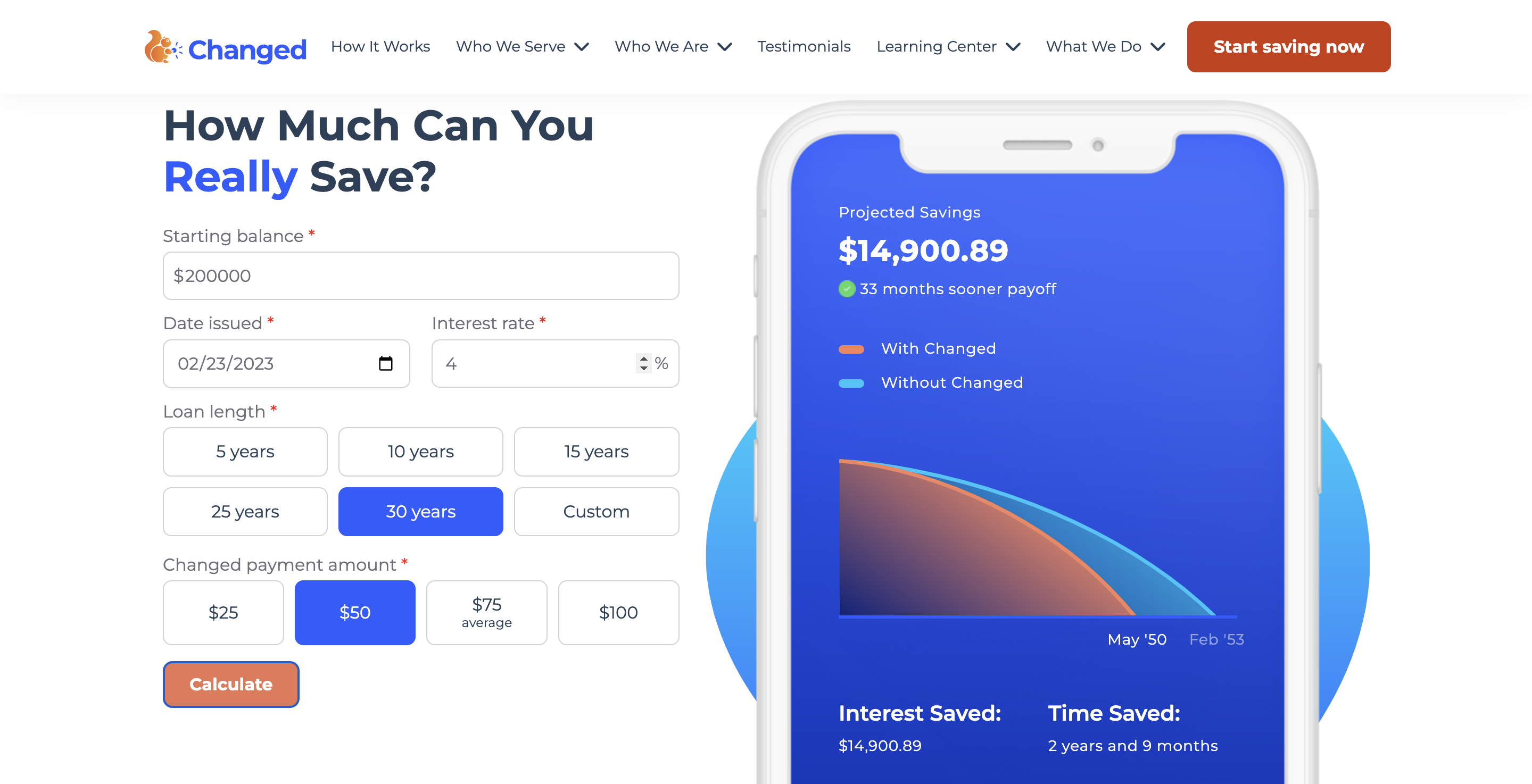

With the Changed App, managing your debt repayment journey and keeping track of your credit score has never been easier. This intuitive tool streamlines the process, allowing you to set goals, create personalized repayment plans, and track your progress—all in one convenient place.