Welcome to 2024 and a unique opportunity for a fresh start.

Embarking on a journey towards financial control can be overwhelming, especially when you're unsure where to begin. The truth is, there's no wrong starting point in personal finance. You can initiate your financial makeover by jotting down expenses on paper or checking your bank account on your phone. Personal finance is more like a web than a straight path – start anywhere, and adjust as you go.

1. Why Not Begin on January 1st?

The new year offers a unique opportunity for a fresh start. To kick off your financial journey in 2024, the first step is to create a budget, so you know where your money is coming from and where your money is going.

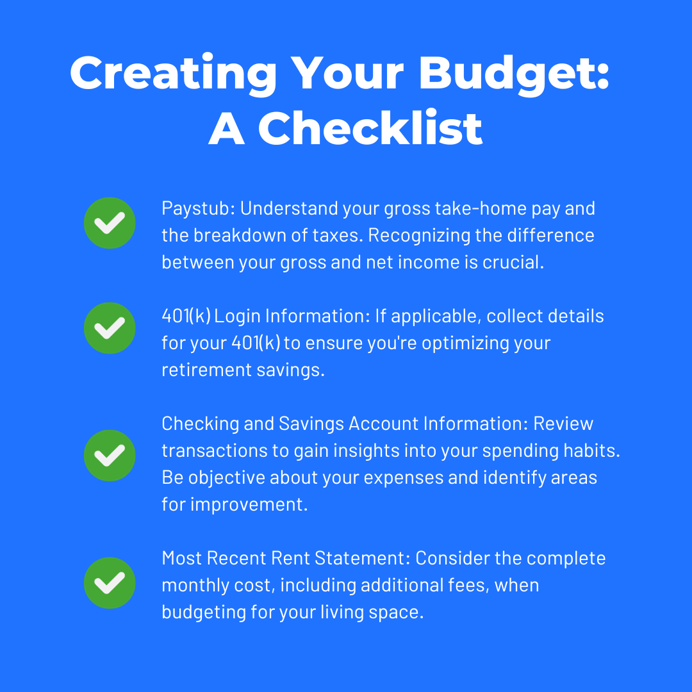

2. Creating Your Budget: A Checklist

Before diving into the budgeting process, gather essential information:

- Paystub: Understand your gross take-home pay and the breakdown of taxes. Recognizing the difference between your gross and net income is crucial.

- 401(k) Login Information: If applicable, collect details for your 401(k) to ensure you're optimizing your retirement savings.

- Checking and Savings Account Information: Review transactions to gain insights into your spending habits. Be objective about your expenses and identify areas for improvement.

- Most Recent Rent Statement: Consider the complete monthly cost, including additional fees, when budgeting for your living space.

3. Now, with this information, set aside some time to comb through your accounts.

Armed with a clear picture of your financial landscape, it's time to delve deeper into the specifics. Carve out a dedicated block of time—perhaps a couple of hours—to thoroughly examine each of your accounts. Think of it as a financial self-audit, allowing you to gain a comprehensive understanding of where your money is and how it's working for you.

4. After you are done combing through your accounts you need to: Figure Out the Basics:

- What is the account?

- Can you log into it?

- Why do you have it, and are you actively using it?

- Is the money invested, or is it sitting in cash losing value?

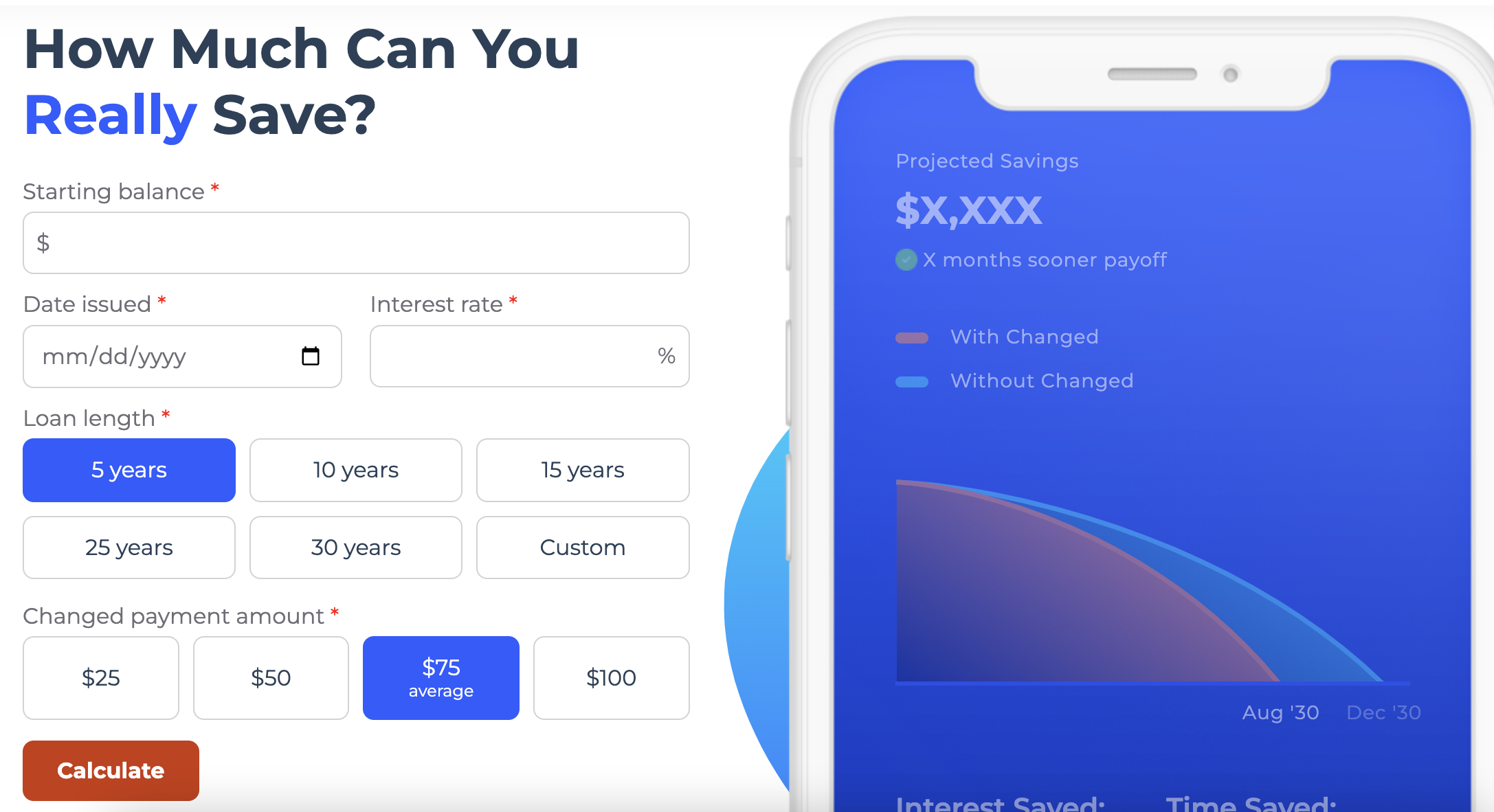

5. The next question you need to ask yourself is: Do you have a debt payoff strategy?

Address high-interest debt, especially credit cards, with urgency. A 24.25% interest rate can really screw with your financial future, it sounds scary because it is. It's ok if you don't have your debt payoff strategy figured out, Changed can help you figure it out.

Go over to the Changed Loan Calculator to find out how much time and money you can save on your debt with Changed.

6. Emergency Fund:

After addressing debt, focus on building or replenishing your emergency fund. Having enough cash on hand safeguards against unexpected expenses. Use the Changed Stash My Cash feature to save alongside debt payoff.

7. Investing for the Future:

Once your emergency fund is in good shape, shift focus to investing. Prioritize tax-advantaged accounts like the 401(k) and IRA. Choose between Roth and Traditional based on your current income and retirement goals.

8. Taxable Investing Accounts:

Consider taxable investing accounts. Money in these accounts is taxed at various stages, so weigh the pros and cons.

9. A Helping Hand with Changed:

In your journey towards financial freedom, consider leveraging Changed. It can accelerate your debt payoff, putting more money back in your wallet. Changed aligns your debt payoff strategy with your budget and utilizes spare change from everyday purchases to make extra debt payments. The Stash My Cash feature ensures your cash is well-managed, allowing you to focus on what truly matters in life.

10. Set yourself up for the win

Investing energy into your financial planning in January lays a solid foundation for a prosperous 2024. After the tumultuous experiences of recent years, many are eager for both emotional and financial recovery. If you navigate January wisely, you position yourself for a year of financial success.

Ready for a financial reset in 2024? Start today, and remember, there's no perfect starting point – just take that first step towards a brighter financial future and do debt differently.