How To Buy a Home When You Have Student Loan Debt

At Changed, we're here to support you on your journey to homeownership, even if you have student loans. We understand the unique challenges you face, and we're equipped with innovative solutions to simplify debt management and empower you to take control of your finances.

Did you know that student loan debt can be a major roadblock for many aspiring homebuyers? According to research by Education Data, almost one-third of individuals with student loans say it has hindered their ability to purchase a home. That's where we come in.

In addition to managing your student loan debt, another critical aspect to consider when aiming for homeownership is your debt-to-income ratio (DTI). Financial institutions carefully analyze your DTI ratio as a key factor in evaluating your eligibility for a mortgage. It measures the proportion of your monthly debt payments to your gross income, providing insight into your ability to manage additional debt and make mortgage payments on time. Maintaining a healthy DTI ratio is essential for securing a favorable mortgage and successfully navigating the home buying process, especially when student loans are part of the equation.

Simply put, your DTI ratio is a measure of your monthly debt payments compared to your gross monthly income.

Understanding Your Debt to Income Ratio

When it comes to obtaining a mortgage, one of the most critical factors considered by financial institutions is your debt-to-income ratio (DTI). Your DTI ratio is a measure of your monthly debt payments compared to your gross monthly income. Lenders use this ratio to assess your ability to manage additional debt and make timely mortgage payments. A lower DTI ratio indicates a healthier financial position, as it shows that you have a more manageable level of debt relative to your income. Lenders typically prefer borrowers with a lower DTI ratio, as it signifies a reduced risk of defaulting on the mortgage. Therefore, it is essential to keep your DTI ratio in check by managing your debt responsibly and maintaining a steady income.

DTI Example:

Let’s take a look at an example. Imagine that you have a total monthly gross income of $6,000. Say that you have the following monthly debts:

Rent: $1000

Student loan minimum payment: $350

Auto loan minimum payment: $350

Credit card minimum payment: $100

In this example, you’d first add up all of your monthly payment obligations for a total of $1,800. Then divide by your total gross income, $6000. Your DTI ratio is 0.3, or 30%.

Assuming you’ll no longer have to pay rent when you buy your first home your DTI would then be 13%. Based on a $6,000 gross monthly income you could afford a payment around $1,320 and still be in a favorable DTI ratio. Our DTI guideline below will explain what is considered favorable.

Take a look at how your current student loan debt compares to your overall income. Though the specific DTI ratio you need for a loan depends on your loan type, most lenders like to see a low DTI ratio. Most lenders see DTI ratios of 35% or less as ideal.

Debt-to-Income Ratio (DTI) Guidelines:

- A DTI ratio of 35% or less is generally considered favorable, indicating manageable debt and potential surplus after paying monthly bills.

- If your DTI ratio falls between 36% and 49%, it is considered adequate but there is room for improvement. Lenders may require additional eligibility criteria.

- A DTI ratio of 50% or higher signifies limited available funds for savings or discretionary spending. This can result in difficulties handling unexpected expenses and limited borrowing options.

Ways to decrease your DTI ratio

If you're looking to decrease your DTI ratio, consider implementing the following strategies:

Paying off Another Debt First

One effective method to swiftly reduce your debt-to-income (DTI) ratio is by making progress in paying off your outstanding debts. By eliminating debt, you eliminate recurring expenses and increase your available cash flow. If you're unable to make extra payments towards your student loans, it may be beneficial to focus on paying off another debt source instead. For instance, paying off credit card debt in full can have an immediate impact on lowering your DTI ratio. By taking this step, you'll witness a noticeable decrease in the ratio, bringing you closer to a healthier financial position.

Increase Your Income

Another strategy to reduce your DTI ratio is to boost your income. Consider taking on additional hours at your current job or exploring opportunities for a side hustle to increase your cash inflow. It's important to note that to include this extra income in your DTI ratio calculation, you'll typically need to demonstrate its regularity and continuity. Lenders often prefer to see a consistent income history spanning at least two years for all your income sources. By augmenting your income through these means, you can effectively lower your DTI ratio and enhance your financial profile.

Your dream home doesn’t have to be a dream.

Your student loans don’t have to keep you from buying your dream home. Remember, your student loans are just one piece of the puzzle. Focus on establishing a solid financial foundation, saving for a down payment, and maintaining a stable income. With careful planning, diligence, and the right resources, you can turn your dream of homeownership into a reality.

Get Changed Today And Let Us Help You Become a Homeowner

Article Sources

Student Loan Debt & Homeownership

https://educationdata.org/student-loan-debt-homeownership

Consumer Financial Protection Bureau. "What Is a Debt-to-Income Ratio?

https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

What’s a Good Debt-to-Income Ratio & How Do You Calculate It?

https://credit.org/blog/debt-to-income-ratio/

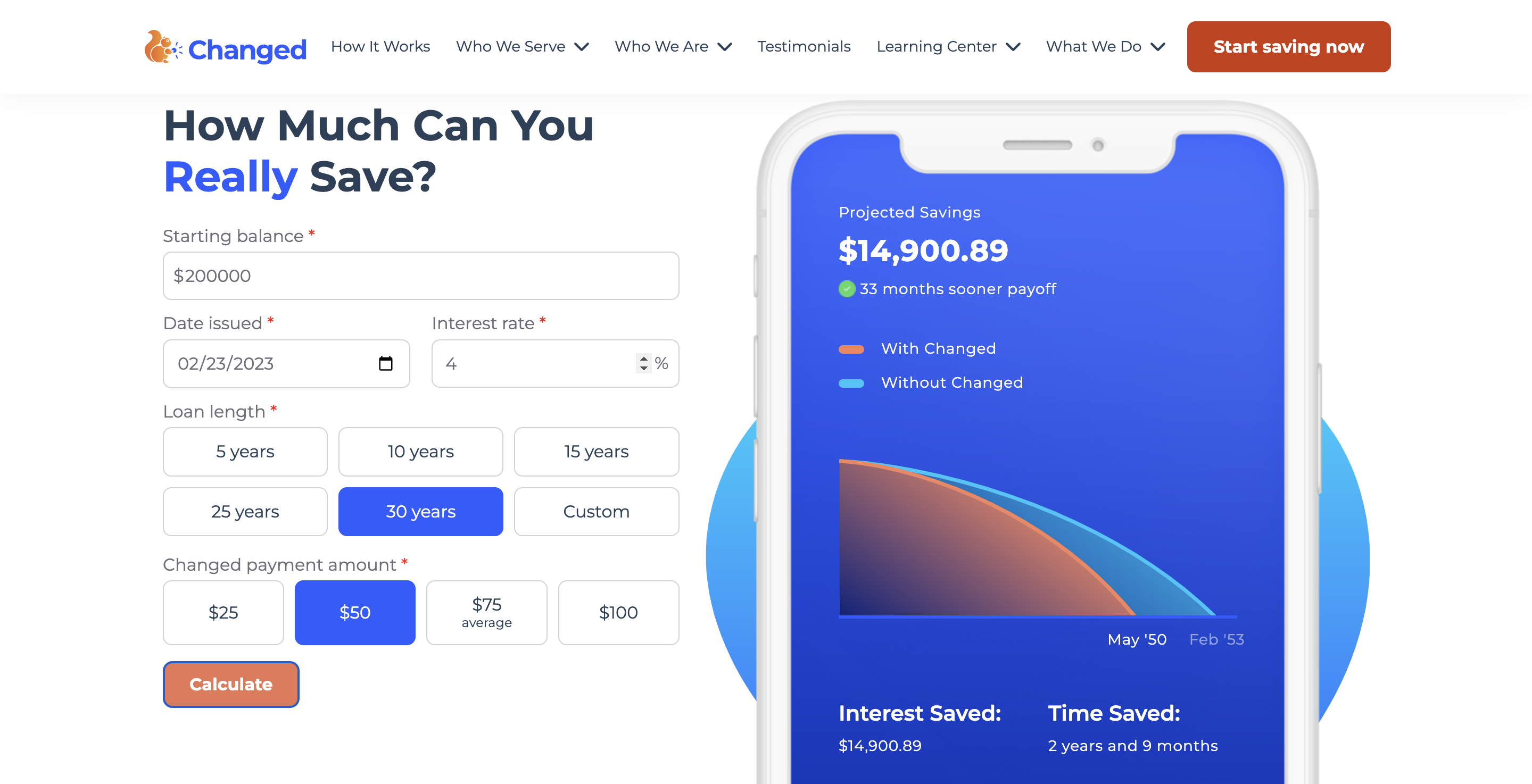

How does Changed work?

The Changed app gives you the ability to link all of your loans and spending accounts into one app. It then analyzes your debt and builds a repayment journey that best aligns with your budget. You can use the round up feature, where your everyday transactions are rounded up to help you save in small increments so you can nickel and dime your way out of debt. All savings and payments are automated and you get to see how much you save with each penny.