Learn Something New

Master your knowledge around debt repayment and make smarter financial decisions in the future.

Earn Perk Points

Each course completed earns you Perk Points. These points give you entries to win free $$$! Earn a shot to win every week!

Win Free Cash

Each week we raffle off free $$$ ($100 minimum). You learn, you pay off your debt, and you win extra cash toward your goals!

FAFSA

The Free Application for Student Aid (FAFSA) is a form that students fill out before each school year to see if they are eligible for financial aid. Even if you think you make too much money to be eligible, you should still fill it out! You might be pleasantly surprised. To fill out the FAFSA, you will need information about your and your family’s finances, including tax returns, so be sure to have that handy before starting the process. Once you've submitted it, you'll receive an estimate for your expected family contribution (EFC). Keep in mind that this is not the final amount you'll have to pay out of pocket! This only gives a baseline of how much financial aid you're eligible for, whether it be federal grants, loans, or work-study.

Expected Family Contribution

Another related benefit to completing your FAFSA is learning your expected family contribution (EFC). Your EFC is how much money the government estimates your family could pay for one year of school. EFC is based on your families income and net assets. Net assets include things like saving accounts, businesses, and investments. Generally the EFC will be lower for low-income students and higher for a family with a high net income.

Grants and Scholarships

Grants are ways the government can fund your schooling without you having to pay it back. There are a few types of grants, but most are given to undergraduate students who display exceptional financial need. The results of your FAFSA will determine if you are eligible for any grants.

Scholarships, similar to grants, do not have to be repaid as well. But unlike grants, they take a bit more effort to apply for. There are hundreds of different scholarships that have different criteria. Scholarships exist for sports, minorities, academics, specific states, schools, and more! It may be a bit of a scavenger hunt, but with a little research, you can likely find a scholarship that you qualify for.

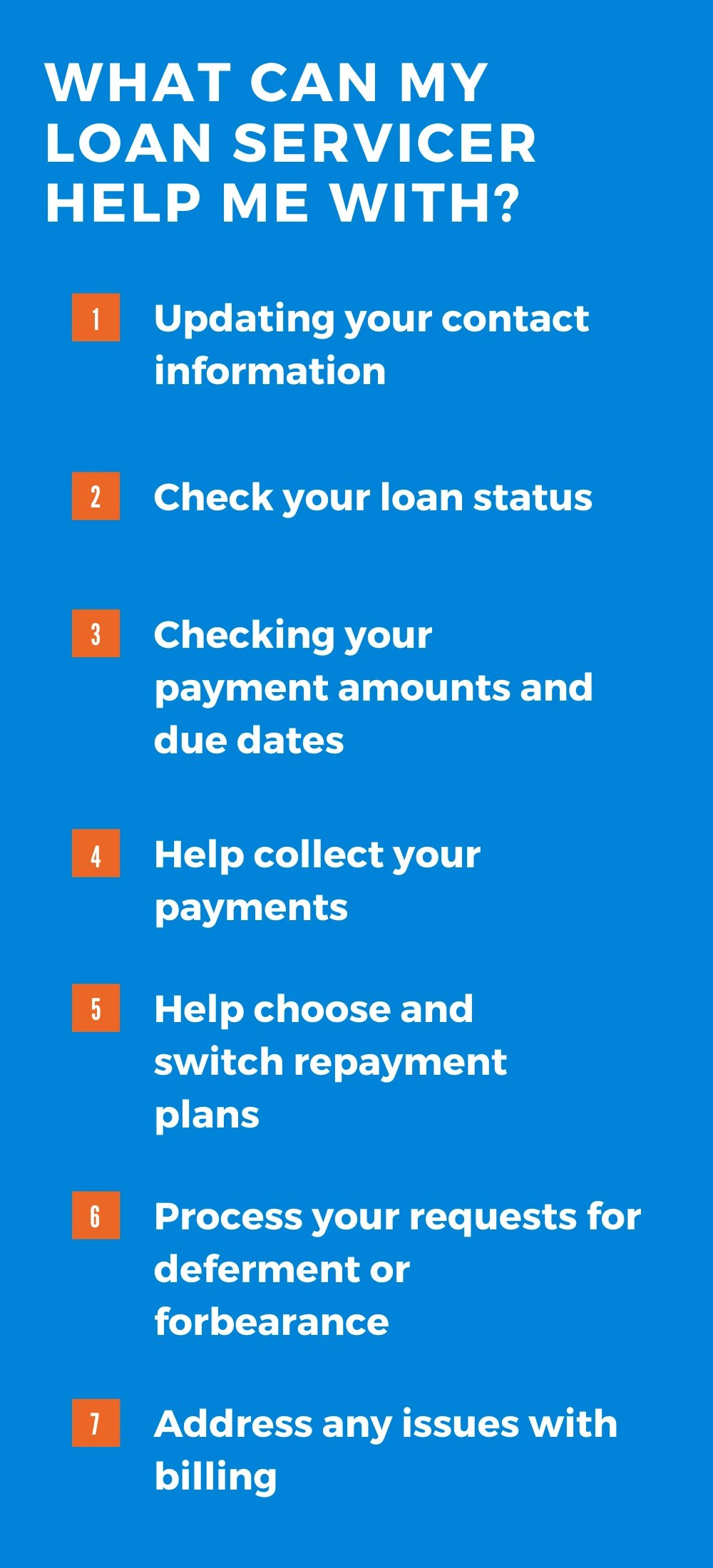

What Is a Loan Servicer?

The loan servicer is the company that will manage your loan, process your monthly payments, and offer support when it comes to making sure you have a comfortable payment plan. Any question you have about your student loan, your servicer has the answer. The Department of Education assigns a servicer to you when you get your loan. As of 2021, the Department of Education works with more than 20 different servicers.

Private student loans (non-federal) can be serviced two ways. First they can manage your repayment directly, or they can also contract the servicing to companies that have the resources to support your repayment needs.

So a lender is someone that lets you borrow money on specific terms, and the servicer is the organization that manages your repayment.

Tip: For every loan you take out, a servicer is assigned. So if you take out multiple loans, you might have a different servicer for each.

How Do I Find My Servicer?

When your student loan was assigned, you should have received a notification about who your servicer is and how to pay your loan off. If you borrowed multiple loans or haven't kept track of who you need to pay, there are resources that can help you find the right contact.

If you're still in school you can reach out to your financial aid office to get information about your student loans. The National Student Loan Database System (NSLDS) is an EXTREMELY helpful tool that stores all details on every federal student loan you have in one place, along with who your student loan servicers are. You can find your federal loan info and more at NLSDS.ED.GOV

What Do They Do?

Once you've tracked down your servicer(s), setting up an online account with them is ideal for making payments and having access to your student loan details. If you want to get updates on the status of your loan or make payments, your servicer is there. They can even help you apply for forgiveness and restructure your repayment plan if needed. If used correctly, they can be a huge help in managing your student loan like an expert.

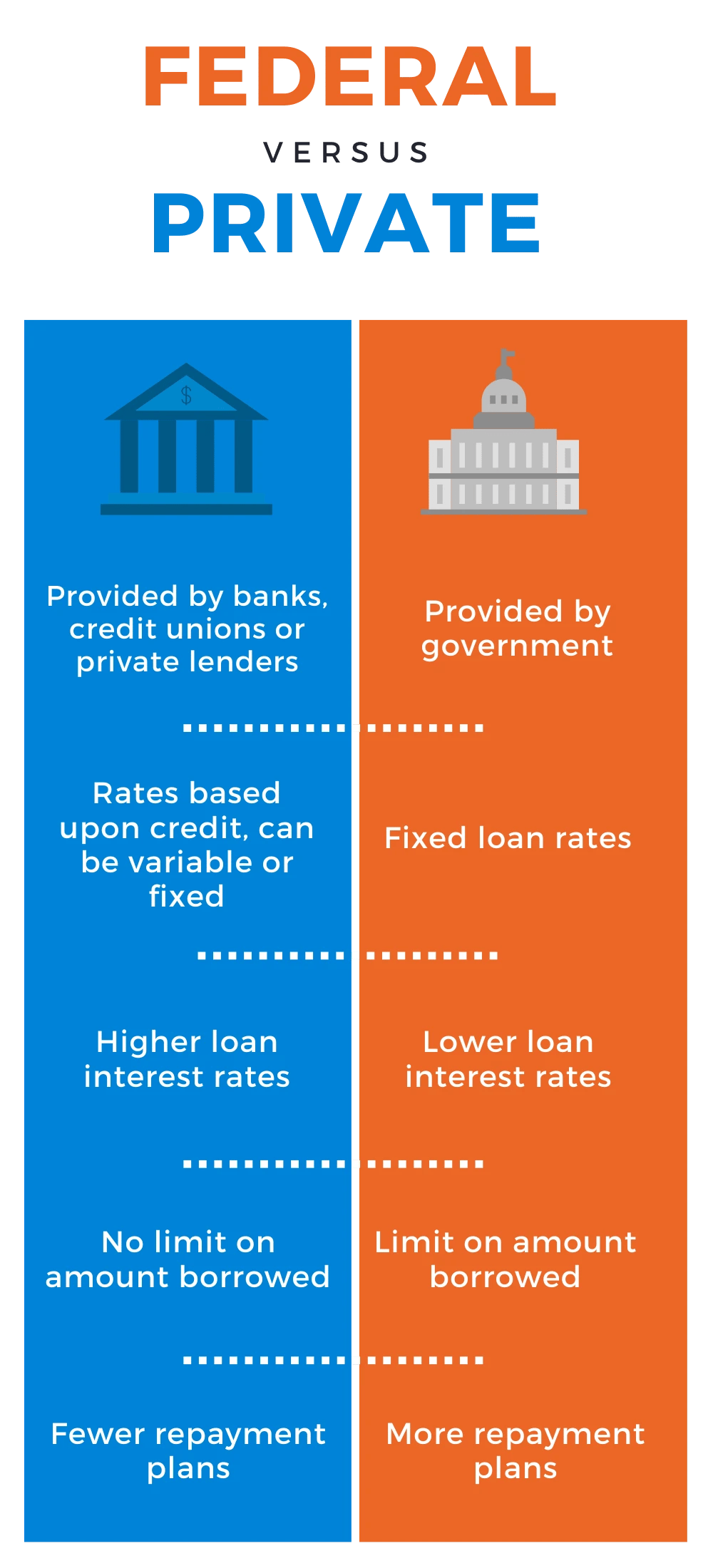

Federal Student Loans

Federal loans are granted by the government, specifically the Department of Education. These loans will either be subsidized or unsubsidized—terms you can read more about in the next section. To apply for a federal student loan, you'll want to fill out the FAFSA. The FAFSA determines if you qualify for a federal loan, taking into account your expected family contribution. Federal loans have set interest rates decided by Congress that won't change over the term of your loan.

The standard repayment term for federal loans is set at 10 years but can be extended if you choose to look into different plans. Federal student loans also have better options if you're struggling with repayment by giving you 270 days before default versus the 120 days for private loans, many helpful repayment plans, and more! The downside is the limited amount you can borrow. Undergraduates can borrow up to $12,500 annually and $57,500 total in federal student loans. Needless to say, federal loans have their limitations.

Private Student Loans

A private student loan is a loan that is not provided by the government. These loans will be issued by a bank, credit union, or some other private company. To apply for a private student loan, you will need to prove you are creditworthy by meeting income and credit score requirements. In most cases, that means also having a cosigner if you're still just a student.

The repayment options on private loans may be limited and give you only 120 days before default. Interest rates on private loans tend to be higher because of the qualifications that need to be met. Private loans can be beneficial when you need a larger loan amount or don't qualify for a subsidized student loan.

Tip: Many lenders can prequalify your expected interest and loan term without making a hard credit pull. If available, this won't impact your credit score when shopping for the best rate.

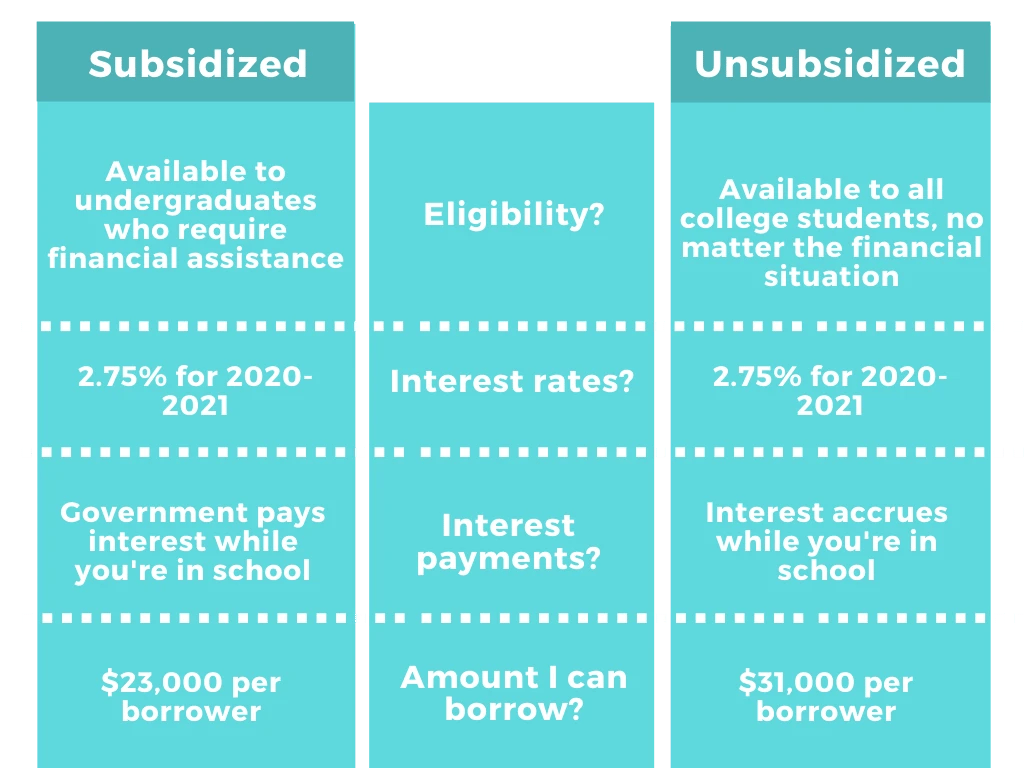

Subsidized Student Loans

A subsidized student loan is a federal loan that the government will pay interest for while you're in school. Not a bad deal, right?! If you put your loan into deferment or forbearance after graduation, they'll also pay the interest on your loan. Another great thing about subsidized loans is the fact that no payments are due until six months after you graduate, commonly known as the grace period. This allows you some time to find a job—which is a huge stress reliever.

Subsidized student loans are not made for everyone; they are targeted toward students who have financial struggles. If your parents make over a certain amount of income each year, then you won't qualify. You can find out if you're eligible for a subsidized loan by filling out and submitting the FAFSA. A maximum loan amount for a borrower is $23,000, so you may have to borrow more through unsubsidized federal loans or a private loan. Sadly, graduate students don't qualify for subsidized loans.

Unsubsidized Student Loans

Unsubsidized student loans are offered by the federal government just like subsidized loans, but they have a few key differences. The biggest difference is that the government doesn't help out with interest while you are in school. This puts more responsibility on the borrower, as you're responsible for paying any interest that accrues while you're in school along with the original loan amount. You can choose not to make payments while in school but your interest will accumulate over time, making your loan balance grow and repayment more difficult.

The good thing about unsubsidized student loans is their inclusiveness. They are offered to graduate students, and you don't need to prove that you need financial help. The maximum loan amount is also higher at $31,000 per borrower, so you can borrow more than a subsidized loan.

Follow this formula: Interest Rate x Current Principal / 365. For example, say I have an interest rate of 5.05% and a current loan balance of $25,000. Do the math: 0.0505 x 25,000 / 365 = 3.45. This means that a total of $3.45 will be added to your loan EACH DAY, making it $25,003.45 after one day. That's a cup of that fancy coffee you always like to get. It seems small now, but over time, that can turn into thousands of dollars if you don't make regular payments!

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

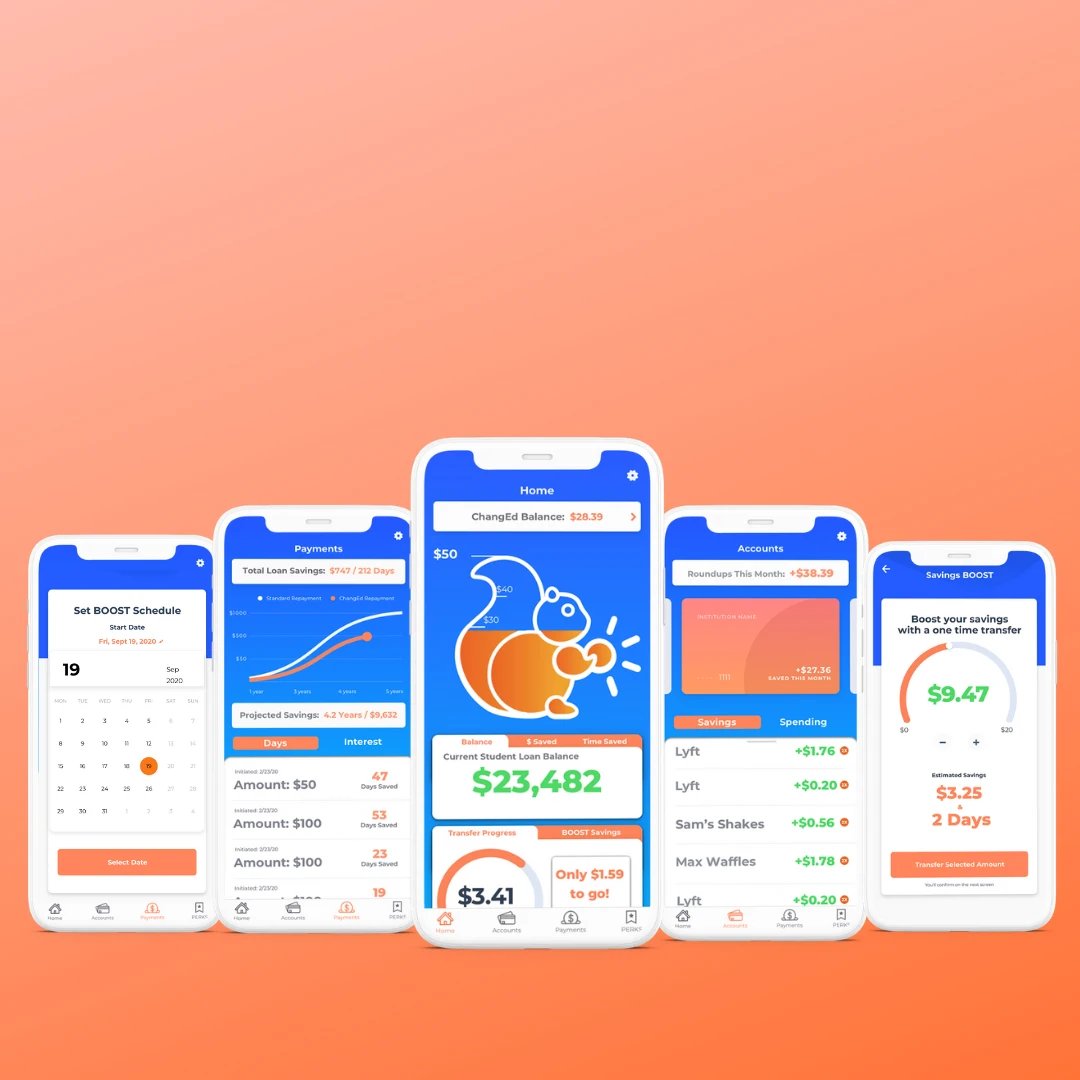

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more