Imagine the day you finally pay off your student loans and finally breathe free of that giant burden. Let’s get past the imagining stage with some simple tips for speeding up the process.

Accelerate your Principal Payments

Anything you can do to reduce the balance on your loan will pay off in two ways. First, you’ve paid off more of your balance. Second, there is less debt remaining to accrue interest, so your loan will be finished sooner.

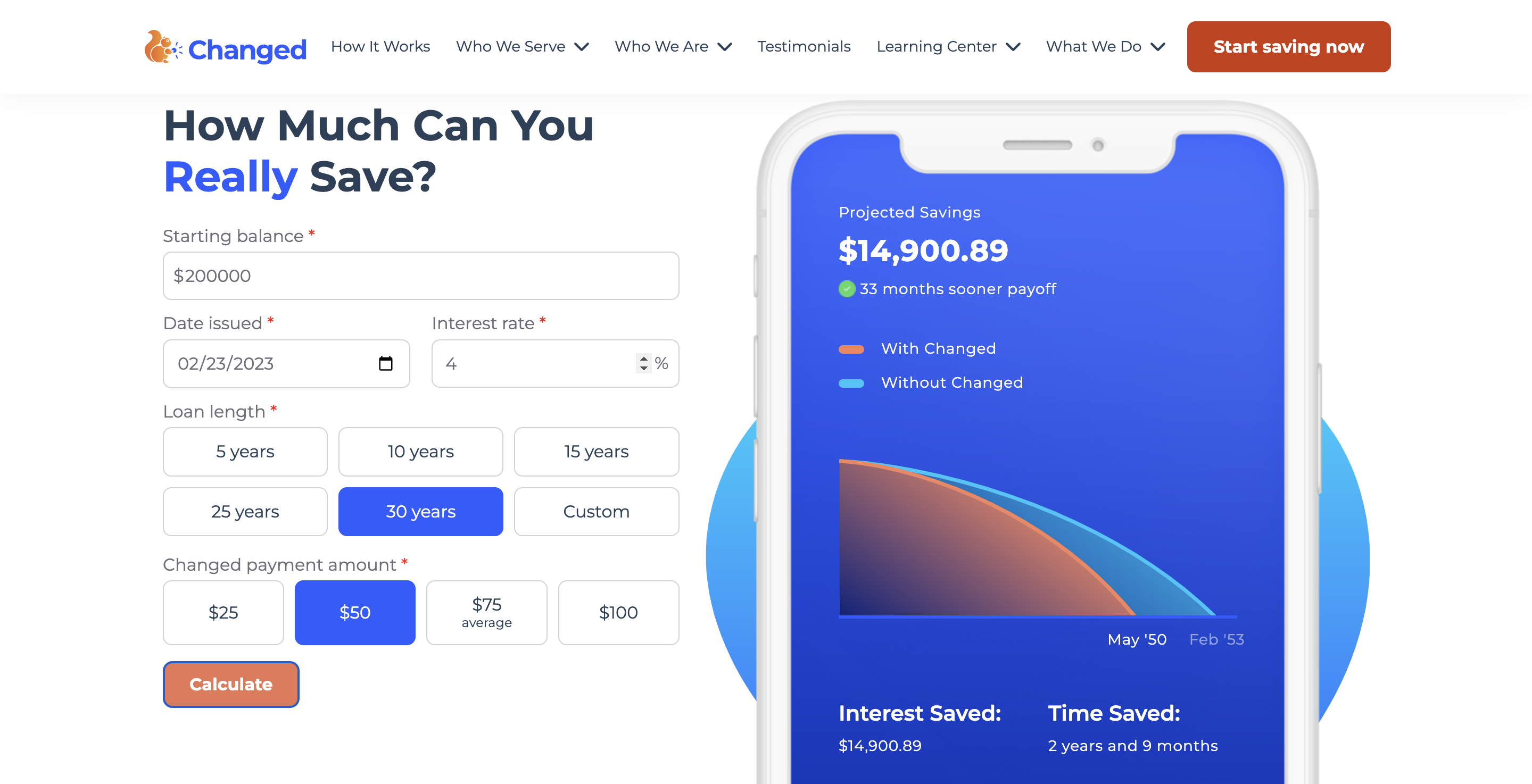

We’re all about acceleration at Changed, because, putting extra money towards your loan is the quickest path to kissing debt goodbye. Putting an extra $20, $50, or $100 towards your monthly can do some serious work on your loan--saving you thousands in potential interest costs and years off your repayment. Whether you add extra money each month or every time you have a few dollars to spare, anything extra will help.

Often, you can simply make your regular loan payment early to multiply the impact of your repayments. If you’re flush with cash on the first and the loan payment isn’t due until the 20th, prepaying will shave a few weeks of interest off that payment. It’s not a ton, at first, but it can build up over time. (If you’re paying your credit card balance in full each month, or your electric bill or gym membership, it usually makes no impact if you pay on the due date or two weeks prior, but it does make a difference with student loans.)

Refinance

This is a great option that can save you some money on interest and get you to student loan freedom quicker. Refinancing your student loan is the process of combining any or all of your student loans into one loan that is managed by a different lender who offers a lower interest rate. Any interest rate reduction can help you save some dough. Learn more about refinancing here.

Automatic Payments

Automatic payments are a great tool to stay on track, not only for student loan payments but for everything from gas bills to cable bills. Missing a payment can result in a fee or be bad news for your credit score, but automating the process avoids those headaches and leaves more time for more important items. There are a few ways you can go about setting up automatic payments.

- Set up automatic withdrawals through your lender. You provide your bank info to your loan servicer, and they’ll withdraw your payment monthly when it’s due. The most amazing thing is that many lenders offer a discount on interest when you enroll in automatic payments. Sounds like a pretty sweet deal to us.

- Adjust your repayment date. Budgeting can be a bit tougher when it comes to automating payments. Contact your loan servicer/lender to adjust the date of your automated payment to fit your budget. This will ensure you’re making payments when you have the funds in your account. Even better, as we mentioned, you’ll get some benefit if you move the payment date earlier than the original schedule anticipated.

- Set up bill pay through your bank. Similar to automatic payments with your lender, you can send automatic payments to your loan through your bank. On the downside, you may be missing out on interest savings that your lender might be offering as a benefit to autopay through them. Also, it does take longer to process payments, which can lead to a late payment if not properly scheduled.

Protip! You can set up small weekly contributions toward your student loans or use ChangEd to help pitch in extra bucks toward your loan, so you can knock them out sooner and save.

Scale Back on Living Expenses

This can be the hardest thing to do but often is the most necessary. If you are serious about getting out of debt, look into every aspect of your budget and see what you can get rid of or how you can do it cheaper. Here are some ideas:

- Cut your rent. If you are struggling with rent, look into possibly getting a roommate. That can automatically cut your biggest bill in half. Moving to a smaller place or a different area can help cut living expenses, as well.

- Get fiscally fit! A good exercise is to track your spending for a month to see where the money actually goes. If you find that you are spending $100 on coffee a month, it might be time to cut back on that. The quicker you scale back. the quicker you will reach the student-debt-freedom finish line.

- Hungry? Cooking is a great way to relax after work and it wouldn’t be a bad idea to make a little extra to bring to work the next day. This can help control both your spending and your diet.

- Really? More clothes??? If you’re free this weekend, take some time to go through your closet. Either wear the shirt you never wear, go to a reseller to sell it, or donate it. This will help you clean up and let go of stuff taking up space. You may just have an extra $100 bucks in your pocket after a good closet purge, and you’ll have a reminder about how much you really don’t need to spend on new stuff.

Protip! Look into side hustles that will make you a little extra dough on top of your normal income. Uber, Lyft, Wag, Rover, Grubhub, and Postmates are all options that can earn you hundreds a month.

Bonus Tip: ChangEd Perks!

Do you ever wish you could get a student loan payment just for being responsible and paying your loans? Well, we are making that a reality! ChangEd Perks is our way of thanking you for using our service and rewarding you for taking control of your student loans. Earn points by referring friends and family, reaching milestones, and getting involved with your student loans. The more points you earn, the more likely you are to win a cash prize towards a student loan payment!