Learn Something New

Master your knowledge around debt repayment and make smarter financial decisions in the future.

Earn Perk Points

Each course completed earns you Perk Points. These points give you entries to win free $$$! Earn a shot to win every week!

Win Free Cash

Each week we raffle off free $$$ ($100 minimum). You learn, you pay off your debt, and you win extra cash toward your goals!

What Is an Expense?

Before you start saving, you have to know your expenses. Your expenses are the cost required for something or the money spent on something. Figuring out how much you spend is the first building block for creating a budget—which is key to saving. Throughout life, you’ll encounter two main types of expenses: fixed and variable. We all encounter both, and it's important to recognize them when it comes to building a master savings plan.

Fixed Expenses

Fixed expenses are the things that cost the same each month. Typically they are things we need or have a legal obligation to pay. Examples of fixed expenses include rent, mortgage, car payments, insurance, phone bills, and other home bills. They are predictable and tend to pop up monthly.

Saving on fixed expenses is simpler than you might think. Even though the word “fixed” implies set expenses, you can often find cheaper alternatives by shopping around. Finding a cheaper phone plan or car insurance requires a few hours of comparing plans and can end up saving you hundreds!

Variable Expenses

Variable expenses are the fun ones. Also known as discretionary expenses, it’s the money you spend on eating out, buying those new Nikes, and going to see the new Marvel movie. They are called variable expenses because they fluctuate month to month.

When we start to try and cut back expenses, these are the things we typically start with. Because of their random nature, variable expenses can be tougher to cut when trying to save. Cutting back on that tasty Starbucks every day can be easier said than done. But it’s important to remember that these are the expenses we have the most control over! Take the time to track these expenses and see what could be cut back on.

What Is Budgeting?

Each month, we have things to pay for. Say you make $2,500 a month and have to spend it on rent, food, bills, and fun. How do you make sure you pay for all those things without seeing negative numbers in your bank account? Introducing ... budgeting! Budgeting is a spending plan based on your income and expenses.

The 50/30/20 Budget

The 50/30/20 budget plan is a popular and simple way to start budgeting. Anyone can do it, and it has real results. To follow this plan, you spend roughly 50% of your income on needs, 30% on wants, and 20% on savings and debt repayment. Note that the income you are spending is after tax dollars, so you don’t have to factor what taxes might take out of your total income.

Start by creating a list of your necessities—things like transportation, groceries, utilities, housing, insurance, and minimum payments on debt. These are the things you need in your life. Does 50% of your income cover that? If it doesn’t, you might have to dip into the 30% designated for wants. Wants are those variable expenses/the fun stuff. And no, your morning vanilla oat milk latte doesn’t count as a necessity! Don't forget it’s important to save and pay off debt, so 20% of your income should go toward that. This budget is easy to follow and will set you up for the long term!

The 30-Day Rule

The 30-day rule is another simple strategy that can be used along with the 50/20/30 rule, especially when it comes to cutting down our wants. The rule is all about limiting impulse buying. Say you're in the store or shopping online and suddenly come across a pair of sneakers. Wow, they are cool. But do you need them? Stop! Take a note, mental or written down, and come back to the idea in 30 days. During those 30 days, think about if you really need or even want them. After those days, you can make the call. You might still want them or realize that you don’t. By implementing this rule, you can control your spending and make smarter financial decisions. According to Credit Karma, almost 40% of millennials have spent money they didn’t have as they try to keep up with others. Limit needless spending and watch just how much you can save!

What Is an Emergency Fund?

An emergency fund is a bank account with money set aside to pay for the unexpected expenses that life throws at us. Maybe your car breaks down or you have a major medical bill. Maybe your house needs a repair. Whatever it is, it's hard to plan for the unexpected. Emergency funds create a nice buffer for when life throws curveballs at us. These types of savings accounts are a great way to not have to rely on a credit card or take out more debt.

How Do I Create One?

Creating a separate savings account for your emergency fund is important so you can keep your money organized. Look for a high-interest savings account that will build up over time; the idea is for savings to multiply in order to have enough to get you through about 3-6 months of expenses if need be. Start off with a few hundred dollars, and from there you can slowly build it. Whenever you have some extra money, put it in. The important thing is to build up the fund over time, so if it’s not in your budget to put $2,000, don’t feel like you have to!

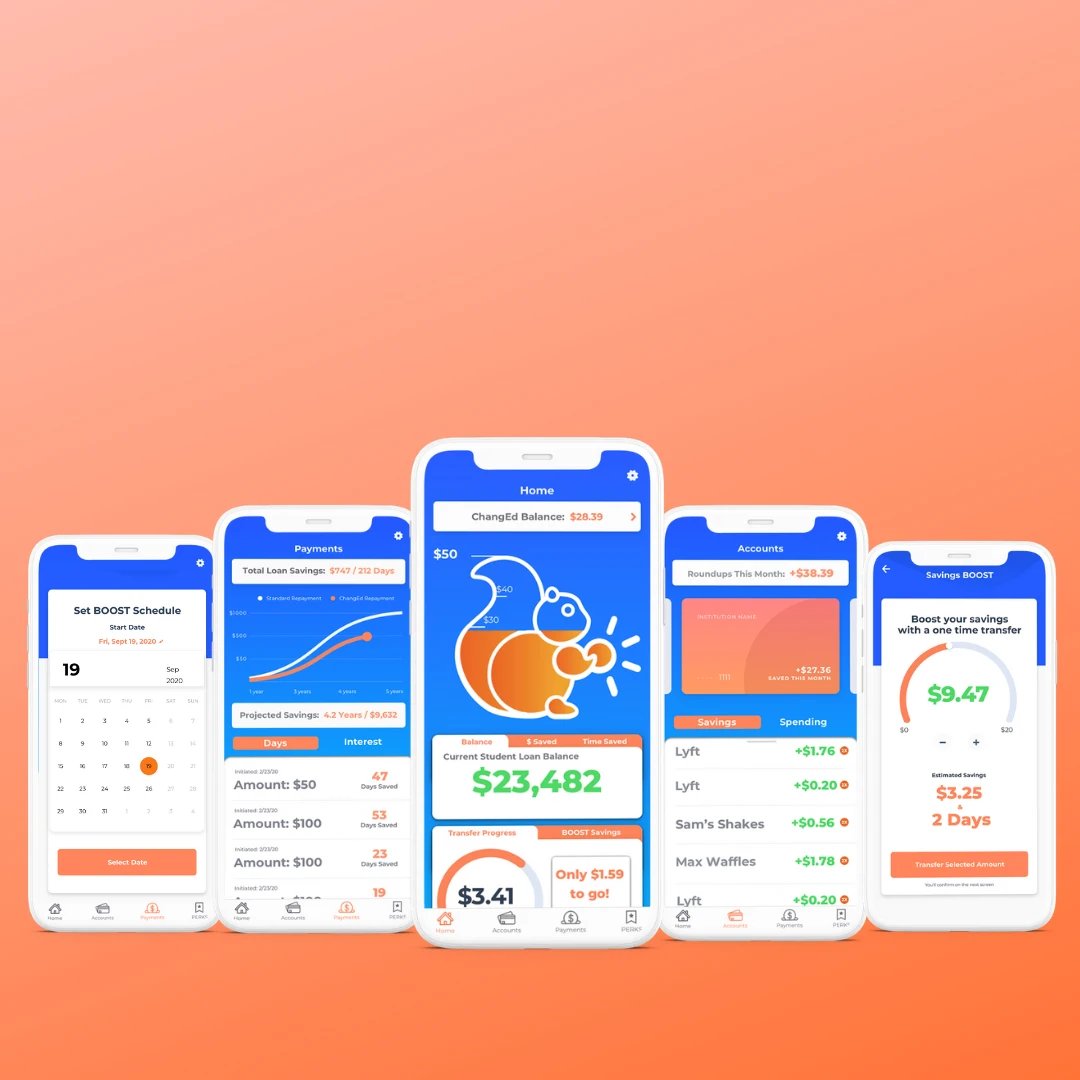

Tip: Changed offers Stash My Cash, where you can split your savings between debt repayment and saving money for an emergency.

When You Should Not Use It.

An emergency fund should only be used for personal financial crisis. It should not be used for expenses that are planned. If you are getting a new car or buying a house, don't dip into your emergency fund! Same thing applies for smaller, unnecessary purchases like clothes or the new iPhone. The last thing you want is to spend money from your Emergency Fund, have an emergency, and then not have any money saved up to help!

Establishing Saving Goals

For some of us, finding reasons to save is difficult. Whether you are a younger person or just enjoy spending money, saving can be tough. But down the road, without a solid savings foundation, you might run into some financial trouble. The best way to avoid this is to establish a savings goal. This way you actively save toward buying something without losing interest while doing it.

TIP: Set up a savings goal in your Changed app and automate savings toward the goal you want to reach.

Short-Term Goals

Short-term savings goals are for the more immediate expenses in your life. These are things you will be spending money on in the near future, anywhere from a few months to a couple of years. Goals like buying a new laptop or making payments toward your debt. Other short-term goals are weddings, vacations, home renovations, as well as creating your emergency fund. Using budget methods like the 50/20/30 rule can be useful in saving for short-term goals.

Long-Term Goals

Long-term saving goals are for when we are thinking big picture. These are goals that will take multiple years to reach, typically 4+. Long-term goals include things like starting a business or paying off a mortgage. Other goals might be saving for a kid's college tuition or saving for retirement. The bigger the picture, the bigger the savings you need! Long-term goals will take more time and attention than short-term ones. It could be in your best interest to set up a savings account for these goals to best stay on top of them. A high-interest savings account will help you keep the money aside and grow it as well.

Opportunity Cost

Opportunity cost is what you give up when making a decision. If you have $100 and spend it on a pair of shoes, the opportunity cost is the next big thing you could have bought with that $100. This is an important idea to keep in mind when you are saving toward a goal. When you’re actively saving for something, spending money on an unnecessary item can negatively affect your savings goal. The 30-day rule is an important idea to keep in mind whenever you're making a purchase!

What Is a Savings Account?

A savings account is a bank account that allows you to store money securely. Typically, you can earn interest on that money as well, meaning the bank actually pays you to keep your money. A savings account allows you to keep your savings separate from your everyday money, making it easier to organize your finances and save for goals.

Why Should I Have One?

A savings account is a must for any person trying to be financially stable in the future. Thinking in the long term is important, and a savings account will help you with goals you might have in the future. Banks treat your savings account as if you have loaned them money. So just like when you have to pay interest on borrowed money, the bank has to do the same for your money.

Banks will typically offer low interest rate returns, the national average being around 0.04%, so you will make a very small amount. You can find higher rates at online banks or with other types of savings accounts. When looking at online banks, always remember to make sure they are FDIC-insured. This means they are secured and your money is safe with them. It's important to note that the money you keep in a savings account usually is not accessible like a checking account. Banks most likely will have a limited number of times you can transfer money online or by debit card.

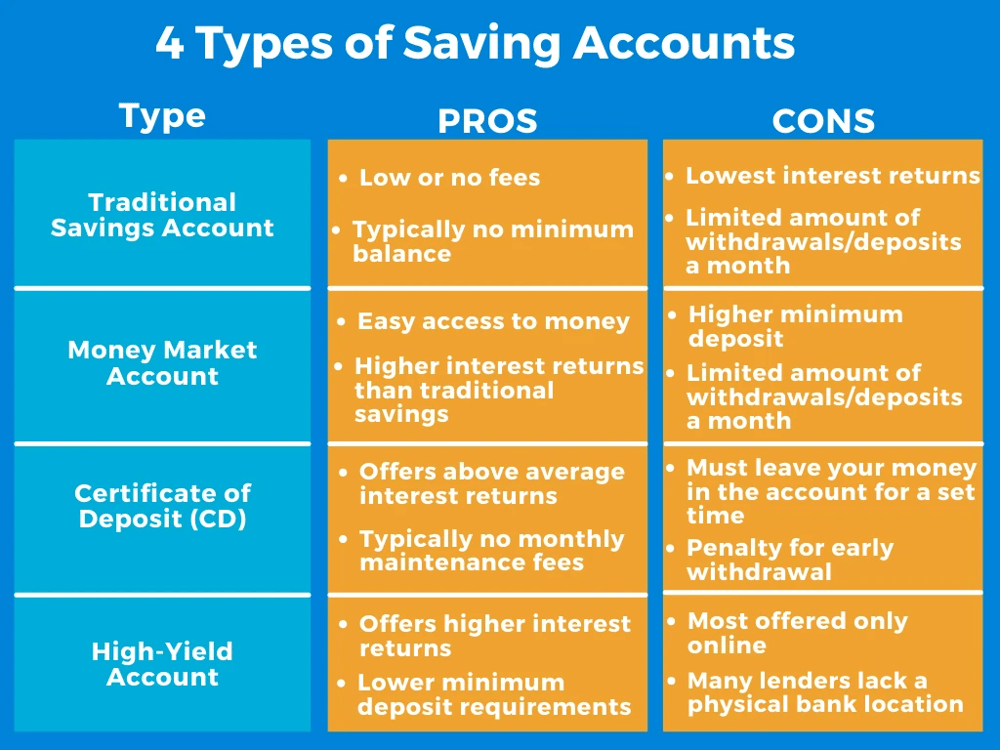

Different Types of Savings Accounts

When thinking about saving your money, you will encounter different types of accounts to do so. There are some for short-term savings and some that are more specialized for things like retirement. It’s important to pick the savings account that best matches your financial wants and needs. The four most common types of savings accounts you can use to store and grow your money are traditional savings accounts, money market accounts, certificates of deposit, and high-yield savings accounts.

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more