Let me start off by saying, let's not shame people with lower credit scores. It's not cute. If thinking about your credit scores makes you want to run away from society and start a new life in the woods, you're definitely not alone. Credit can be pretty confusing and difficult to deal with, especially when you're just starting out.

But the good news is, once you learn some credit basics, it can make it so much easier to build a healthy score. And a higher credit score can help you get approved for a mortgage, pay lower interest rates, and take advantage of credit card rewards.

If you want to know the ins and outs of credit scores, so you can Monitor, Manage, Master - Your Credit Score.

In this blog, let's talk about what the most important factor is when it comes to your credit score and how to improve it.

What is the most important factor when it comes to your credit score?

Your credit score is a numerical representation of your creditworthiness, and it's influenced by several factors. However, one of the most crucial elements is your payment history. This includes whether you've paid your bills on time, how frequently you've missed payments, and if you've ever defaulted on a loan.

Which Bills Contribute to Your Payment History?

Your payment history encompasses various bills, including credit card payments, loan payments (like student loans, auto loans, or personal loans), mortgage payments, and even utility bills if they are reported to credit bureaus. Essentially, any bill you're obligated to pay on time can impact your payment history.

5 Ways to Improve Your Payment History

- Automate Payments: Set up automatic payments for your bills to ensure you never miss a due date.

- Create Reminders: Use calendar reminders or financial apps to alert you of upcoming payments.

- Budget Wisely: Manage your finances effectively to allocate enough funds for all your bills.

- Negotiate with Creditors: If you're struggling to make payments, contact your creditors to discuss alternative payment plans.

- Monitor Your Credit Report: Regularly check your credit report for inaccuracies or errors that could negatively affect your payment history.

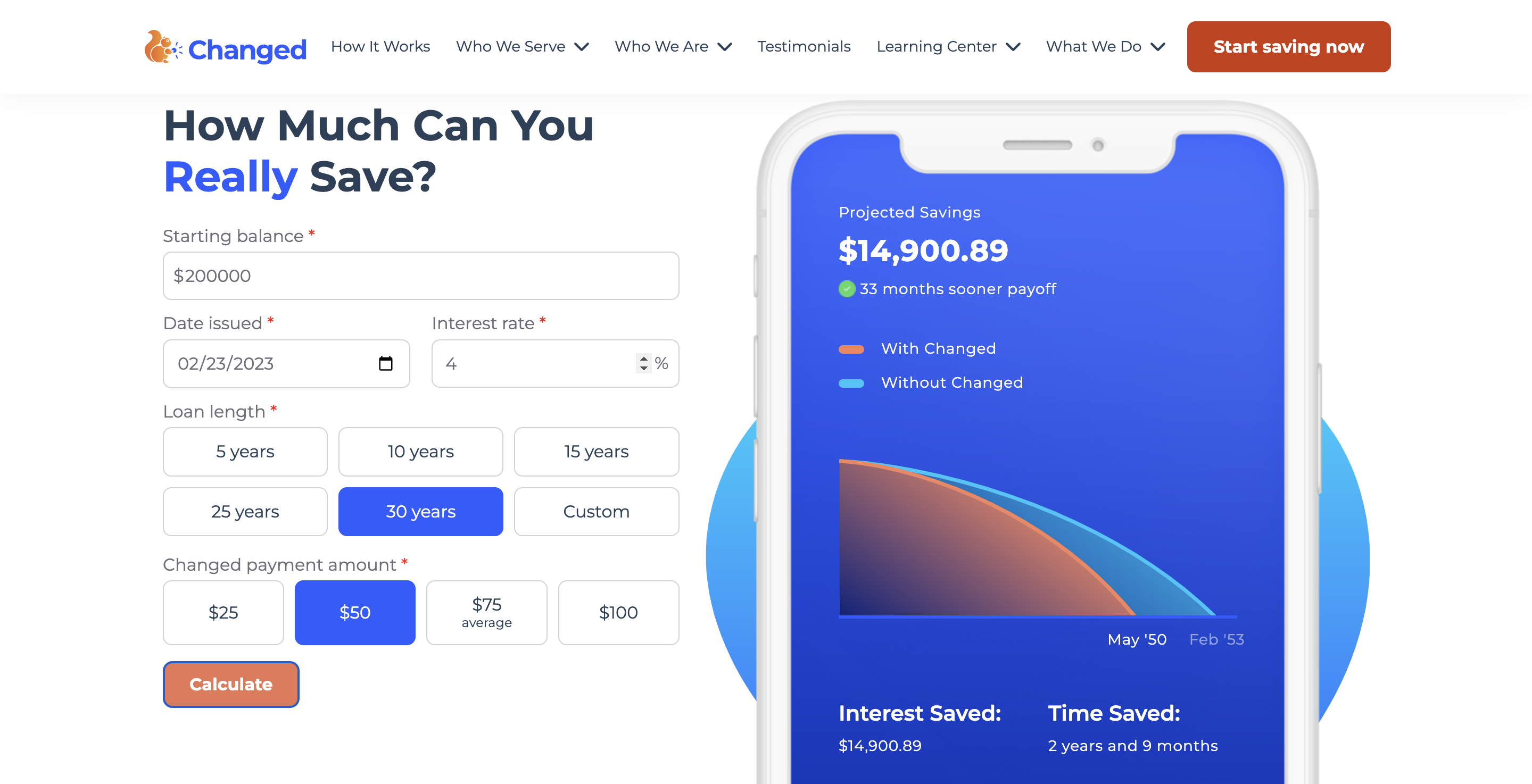

- Let technology help: If you have debt and want a good credit score, link your debts and your credit score to Changed and see your score rise as you pay off debt.

Regardless of your current credit score—be it poor, fair, good, or excellent—focus on mastering the five key credit factors. By following the tips shared above, you can boost your credit score gradually and keep your credit history in good shape. Achieving a solid credit score opens doors to various financial opportunities along the way.

Sign up below for monthly blogs on how to take your finances to the next level.