Ready to tidy up your finances and breathe some fresh air into your wallet? Just like sprucing up your closet or car, a little TLC for your finances can keep you cruising smoothly all year long.

Let's dive in!

1. Review your budget

Each week, track your spending, even those little treats you sneak in. By doing this, you'll get a clear view of where your money goes and can make smarter budget choices. It's easy to swipe without realizing where your money is going, so jotting down expenses or using a banking app can help you understand your spending habits better.

2. Organize your financial goals and see what is working — and what is not

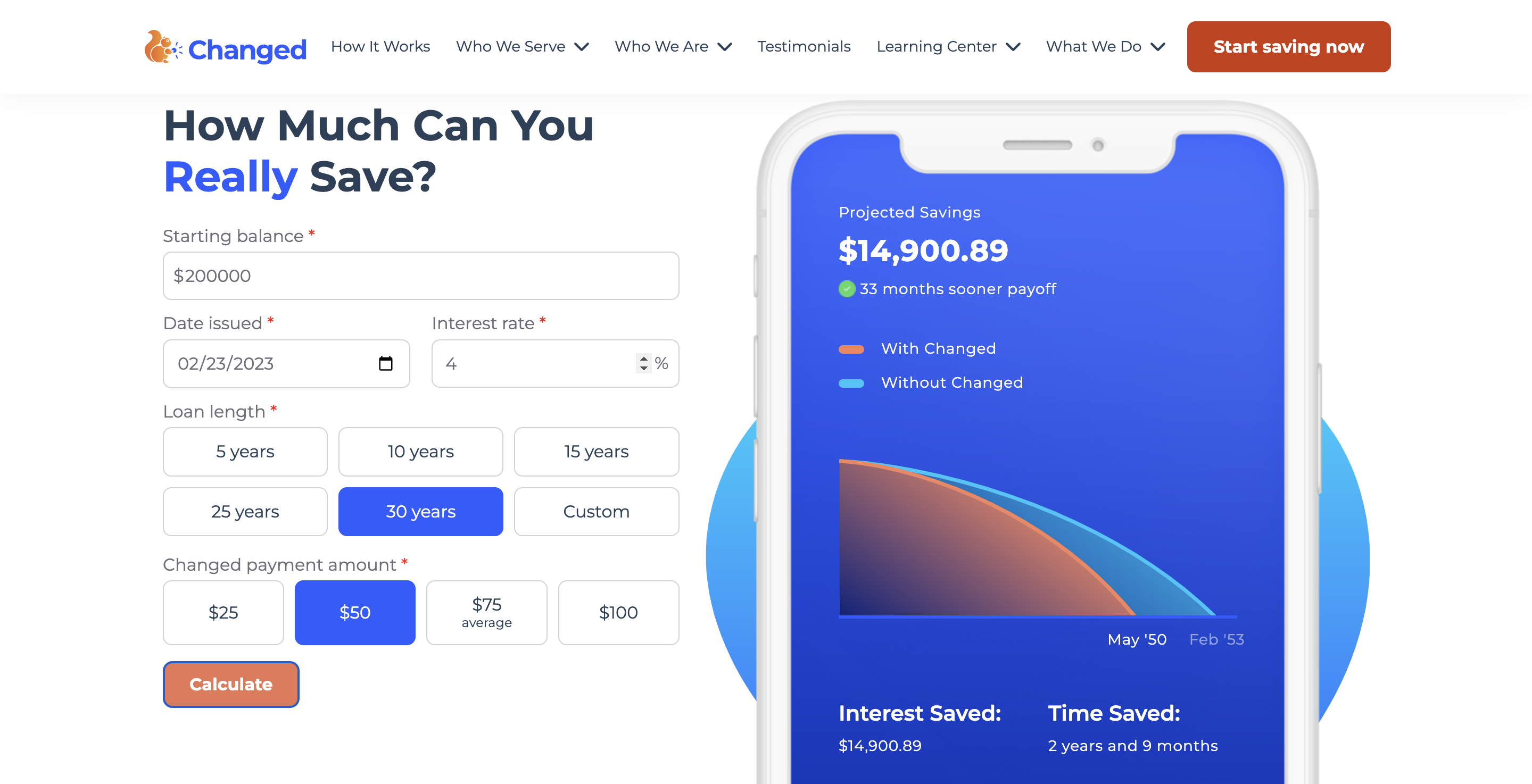

Time for a financial goal check-in! Review those goals you set earlier this year. Are they still singing your tune, or could they use a remix? For example, if you planned to pay off a credit card in three months, check if you're on track. If not, figure out what changes you need to make. This might also be a good time to try out Changed, the app that helps you keep track of and pay off all your debts in one place, making it easier to see your progress.

3. Maximize your retirement contributions

Make the most of your retirement savings by maximizing your contributions, especially for IRA accounts. For the 2023 tax year, you have until April 2024 to maximize your IRA contributions. For those planning ahead for 2025, start contributing early and regularly to take advantage of compound interest. Automatic contributions can be particularly beneficial in this regard.

4. Start Building an Emergency Fund Today!

Emergency fund, assemble! In a world of high-interest rates and surprise plot twists (hello, layoffs!), having an emergency fund is crucial. Having an emergency fund ensures you can pay rent or cover bills if you lose your job or face unexpected expenses. It's the best way to avoid getting into expensive debt.

With a well-funded emergency fund, you won't need to borrow money or rely on credit cards during emergencies. It's a smart financial move. Plus, consider using the Changed app's "Stash My Cash" feature to save for emergencies effortlessly.

Get the Changed App to start doing debt differently