The Supreme Court is currently considering the fate of the federal student loan pause that has been in effect since the COVID-19 pandemic began. As the debate around President Joe Biden's student loan forgiveness plan continues in the Supreme Court, there's no denying that around 25 million Americans will still have to repay their student debt.

It's time to face the facts - those millions of people need to prepare for student loan payments to resume. Experts suggest that borrowers must act fast as repayment is expected to begin either 60 days after the Supreme Court's decision on the relief program or 60 days after June 30, whichever comes first, meaning repayment is likely to begin this summer or fall.

If you're one of the millions of borrowers with student debt, it's time to get your finances in order and prepare for the resumption of payments.

Here are some tips to help you prepare, regardless of the decision made by the Supreme Court.

1. Review your loans: Take a close look at your loans and make sure you understand the terms, interest rates, and repayment options. This will help you make informed decisions about your payments.

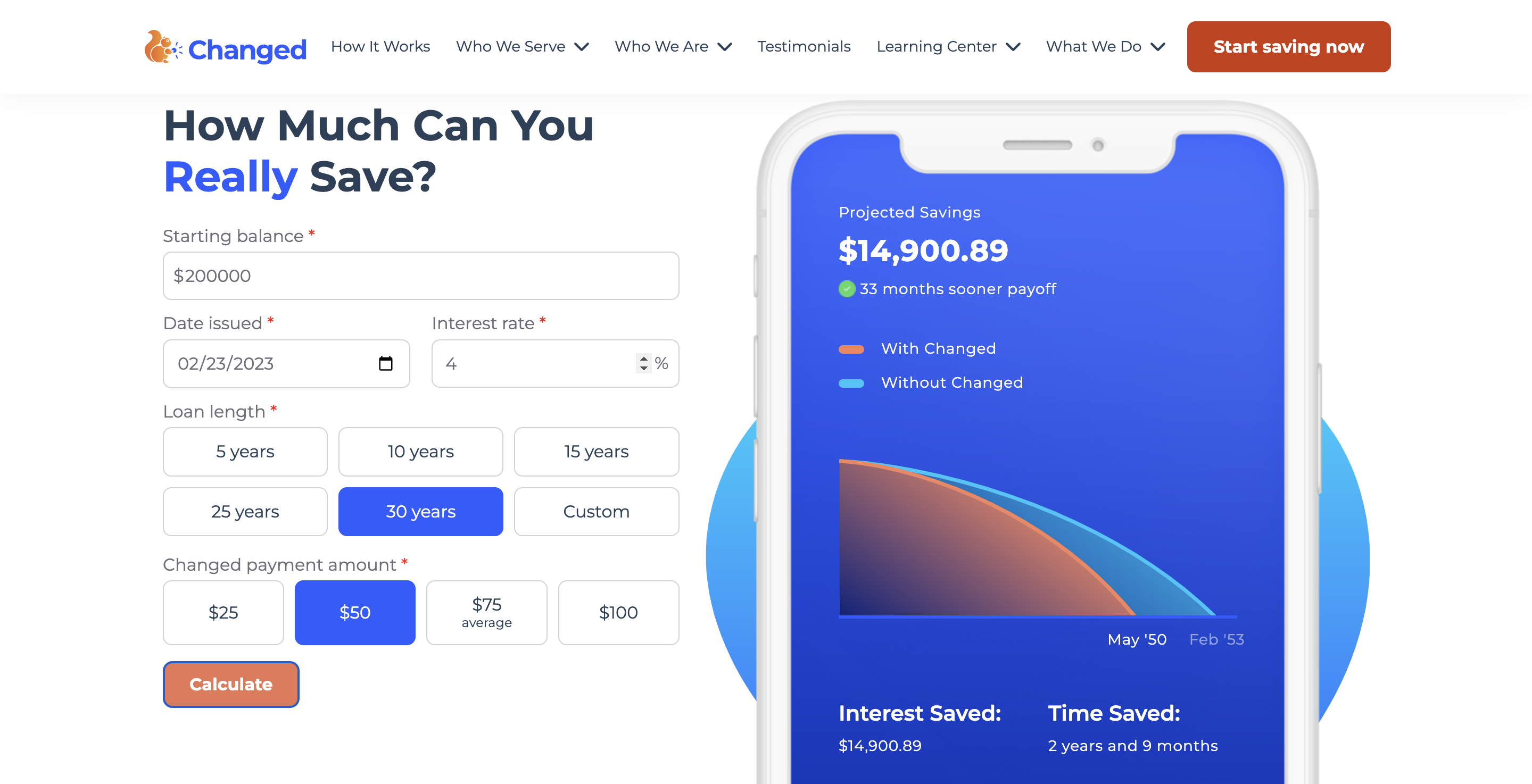

2. Estimate your monthly payments: Use a student loan calculator to estimate your monthly payments based on your interest rate, loan balance, and repayment term. This will help you prepare your budget and ensure you can afford your payments.

3. Create a budget: Once you know your monthly payments, create a budget that accounts for them. Consider cutting expenses or increasing income to free up money for your payments.

4. Determine your repayment plan: Review your current repayment plan and see if it still works for you. You may want to switch to a different plan that better fits your financial situation.

5. Consider consolidation or refinancing: If you have multiple loans, consolidating them can simplify your payments and potentially lower your interest rate. Refinancing can also lower your interest rate and monthly payments, but it may not be the best option for everyone.

6. Explore repayment assistance programs: If you are struggling to make your payments, look into repayment assistance programs such as income-driven repayment plans, deferment, or forbearance. These programs can help lower or temporarily pause your payments.

7. Plan for the future: Consider your long-term financial goals and how your student loan payments fit into them. If you want to buy a house or start a business, for example, you may need to adjust your budget and repayment plan accordingly.

8. Stay informed: Keep up to date with any changes in federal student loan policy, regardless of the decision made by the Supreme Court. This will help you make informed decisions about your loans and payments.

Finally, don't ignore your loans or fall behind on payments. This can have serious consequences, such as damage to your credit score and wage garnishment. Stay on top of your payments and contact your loan servicer if you have any questions or concerns.

Get the Changed App and let us do all the heavy lifting for you so you are perfectly equipped for the resumption of your student loans payments.

Preparing for the resumption of student loan payments may seem overwhelming, but taking these steps can make the process easier and help you avoid potential problems. By knowing your loans, estimating your monthly payments, considering consolidation or refinancing, exploring repayment assistance programs, planning for the future, and staying on top of your payments, you can successfully navigate for the pause to end.