Look familiar? You may have seen Changed before:

Change the way you pay off debt.

Aakash had more than $70,000 in debt. He was trying to pay it down as fast as possible and used Changed as the added catapult to get him over to debt freedom. Aakash needed a new car and a vacation, and now that he’s debt-free, he might just drive to Hawaii! Kidding ... but more vacations are now on the horizon.

"I loved that while I was aggressively paying off student loans, I was still indirectly making micropayments when I went to buy groceries or fill up my car with a tank of gas. Most people don't think about how those micropayments can help eliminate the wrath of student loan interest, so I'm extremely grateful for Changed for helping me get

rid of interest quicker!"

Enjoy mindless savings.

Devin earned her Masters in Biology and now works as a senior research assistant in a virology lab. Because of her student loans, Devin couldn't save and would always have to plan the times to hang out with her friends due to budget restraints!

"Changed was great because it was mindless saving based on my own spending. Sometimes when I set a goal to save X amount of money, it can feel like I'm "losing" a lot of money at once if I move it to a separate account. But with Changed I never missed the money that it saved for me. Towards the end of my loan I was really trying to boost my monthly payments and having the option to set a fixed amount for Changed to save every week, in addition to what was being rounded up, was very helpful."

Uncover new opportunities.

Chris had $30,000 in debt that took him over a decade to overcome, but Changed made it part of his routine to get ahead. He wished he prioritized his debt sooner so he could take the career opportunities he was dreaming about. Now, Chris is in the position to take off!

"It was easy. I didn't have to think about increasing my repayment amounts. It made my payments part of my routine and having the app began my focus on eliminating my debts."

Start paying down your debt today.

How to Get Started

No matter what stage of life you're in, whatever your next big financial goal, debt repayment can feel overwhelming. But with the right tools at your fingertips, you can take control of your debt once and for all.

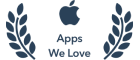

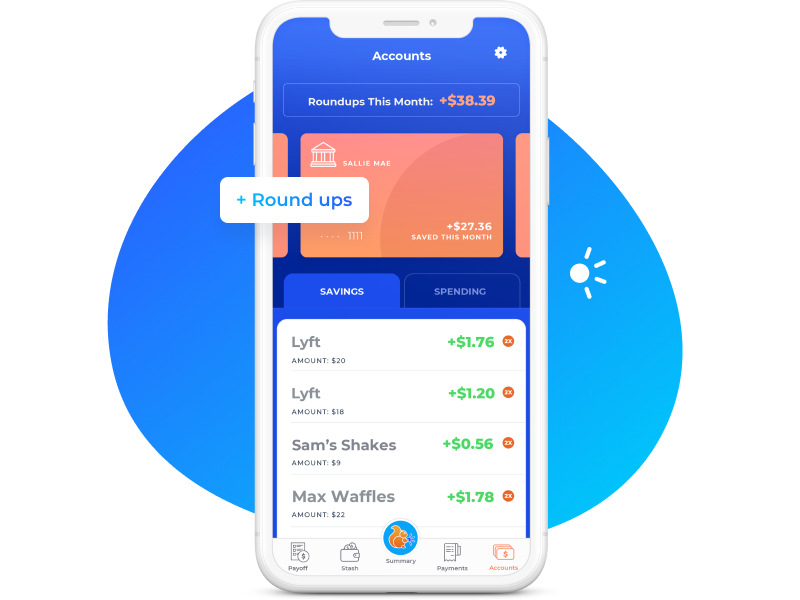

Round Up Savings

When Devin grabs a caramel macchiato in the morning ($4.73), or meets up with friends on the weekend for sushi ($22.64), she swipes her card and forgets the rest. So what if, in the background, that extra bit of change on every purchase was being put to good use?

That's exactly how Changed operates. Changed tracks your spending and rounds up to the nearest dollar, so you can save big over time without ever feeling the burn.

Set Savings Goals

Stuck between building your savings and paying down debt? With Changed, you don't have to choose. We help you establish an emergency fund, set aside money for a downpayment, or work towards any number of your money-saving objectives. It's streamlined savings, all from the palm of your hand.

Take Jake, for example. Jake didn't let paying down debt stand in the way of pursuing his dreams. In fact, thanks to Changed, he knocked out his debt repayment in just 5 years. Today, he's one step closer to purchasing the home of his dreams.

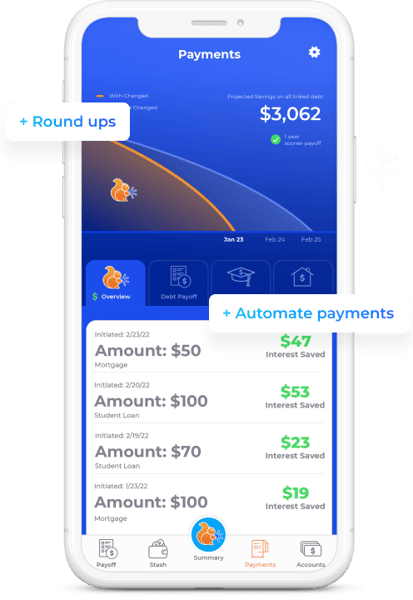

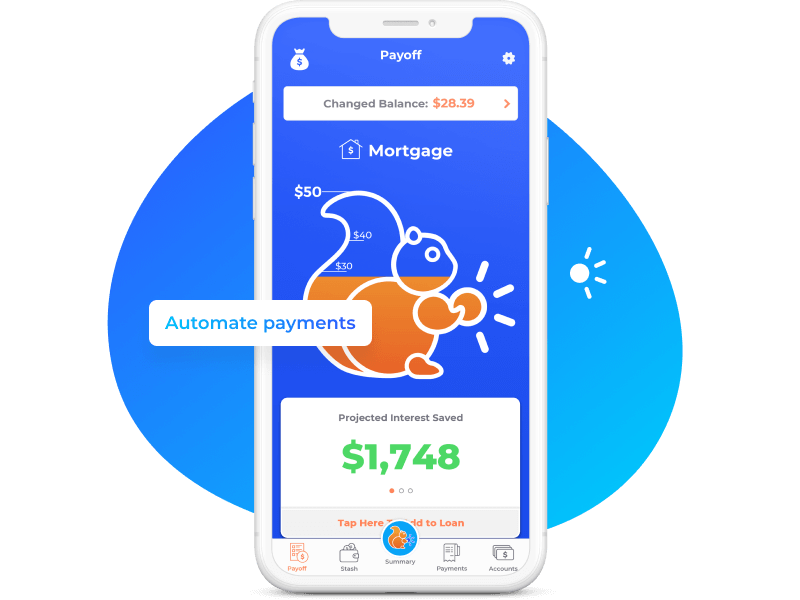

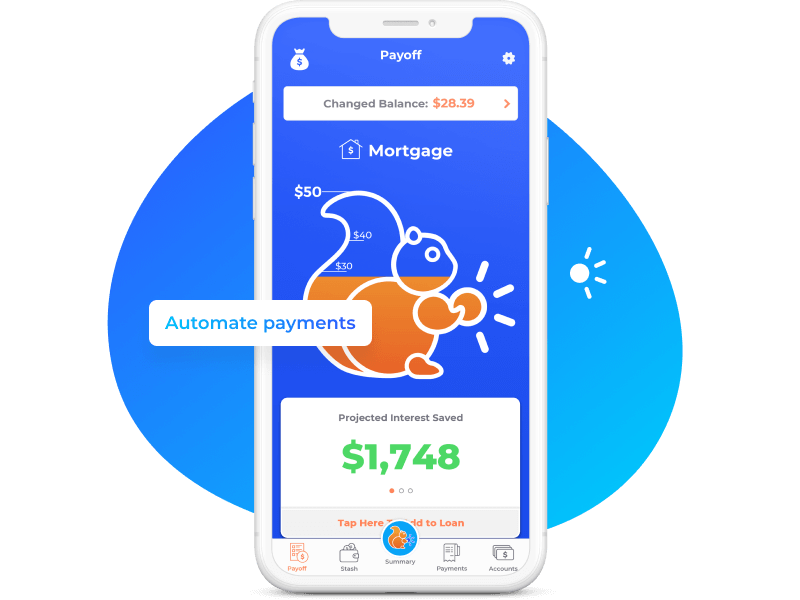

Automate Payments

For Aakash, automated means out of his way. Every time Aakash saves, those micro-savings go directly toward paying down his debt. That means Aakash is one step closer to living debt-free and jet-setting off into the sunset on his next travel adventure.

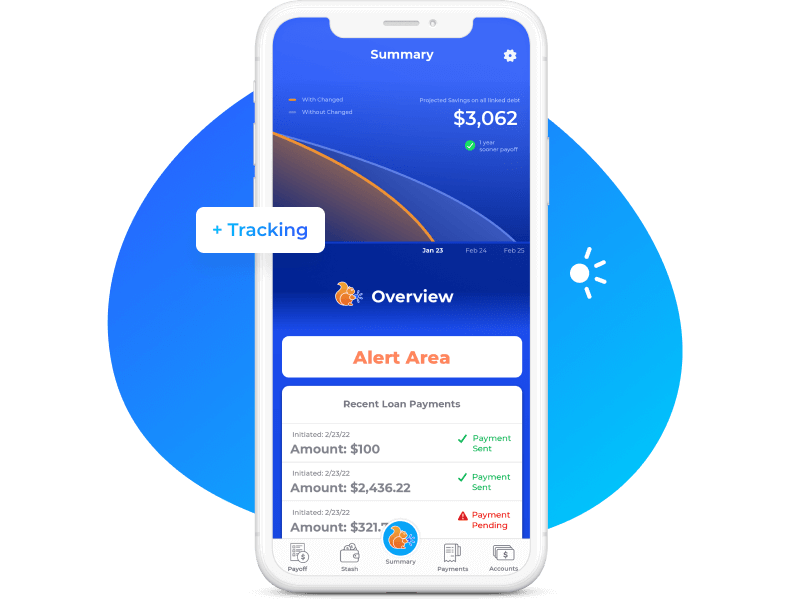

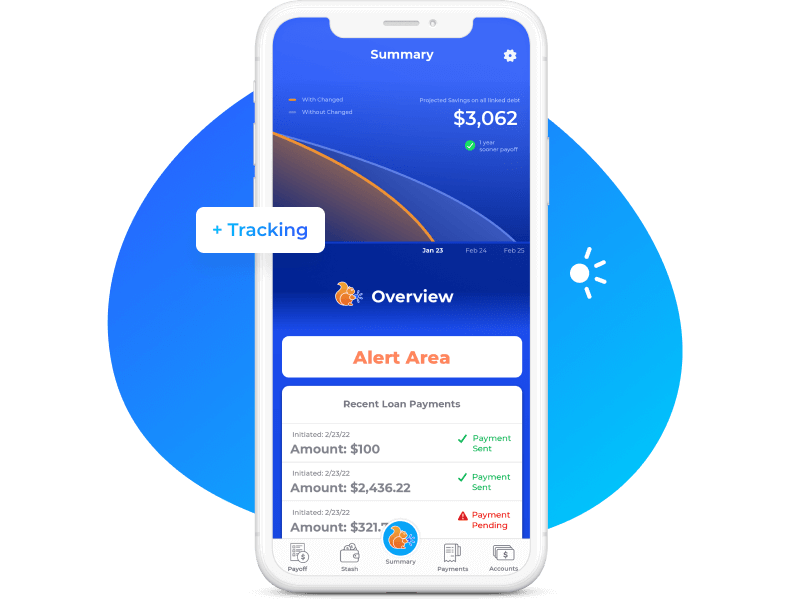

Track Your Progress

Keep the money-saving momentum going with in-app tools to track the progress of your savings. What better motivation than keeping tabs on your small victories along the way? That’s what Drew did–and look where he is now.

Round Up Savings

When Devin grabs a caramel macchiato in the morning ($4.73), or meets up with friends on the weekend for sushi ($22.64), she swipes her card and forgets the rest. So what if, in the background, that extra bit of change on every purchase was being put to good use?

That's exactly how Changed operates. Changed tracks your spending and rounds up to the nearest dollar, so you can save big over time without ever feeling the burn.

Set Savings Goals

Stuck between building your savings and paying down debt? With Changed, you don't have to choose. We help you establish an emergency fund, set aside money for a downpayment, or work towards any number of your money-saving objectives. It's streamlined savings, all from the palm of your hand.

Take Jake, for example. Jake didn't let paying down debt stand in the way of pursuing his dreams. In fact, thanks to Changed, he knocked out his debt repayment in just 5 years. Today, he's one step closer to purchasing the home of his dreams.

Automate Payments

For Aakash, automated means out of his way. Every time Aakash saves, those micro-savings go directly toward paying down his debt. That means Aakash is one step closer to living debt-free and jet-setting off into the sunset on his next travel adventure.

Track Your Progress

Keep the money-saving momentum going with in-app tools to track the progress of your savings. What better motivation than keeping tabs on your small victories along the way? That’s what Drew did–and look where he is now.

Take a closer look at the all-in-one debt repayment app.

How Much Can You Really Save?

Projected Savings

$X,XXX

![]() X months sooner payoff

X months sooner payoff

With Changed

Without Changed

Aug '30

Dec '30

Interest Saved:

$XXX.XX

Time Saved:

X years

This calculator estimates your savings based on use of Changed for the life of your loan. The calculator is an approximation and may not be accurate to your exact loan.

Plans starting at $4 a month could save you thousands in interest.

Less Debt, Less Stress.

Looking for a little inspiration? See how these people use our app to accelerate their debt repayment and transform their financial futures.

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Read more

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read moreOur impact on borrowers like you:

I love how easy it is to "set it and forget it." Engagement with the Changed team always puts a smile on my face.

It was painless to become debt free with Changed. I tell all my friends about it.

I didn’t even have to think about it. Changed has made a huge difference in my journey toward repayment.